My Great Retirement Dream: Sell My House, Downsize, Live off the Proceeds and Dabble in Stocks: Can I Do It?

Retirement is still many years out. but here's what I envision and whether or not it's realistic.

For me, retirement is at least fifteen years away, but that doesn’t mean I can’t dream a little dream.

My great retirement dream? Sell my house once my two kids are off to college, downsize, and use some of the proceeds to dabble in the stock market.

I’ve written about investing and money for years and have always wanted to give it a shot but life gets in the way.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Marriage, children, childcare, saving for college and retirement, divorce, the list goes on and on. Now I’m itching to give it a whirl when I eventually reach my second act.

How I want to live

Ideally I would like to have a home or condo near my children, wherever they ultimately land, and another place somewhere more excotic like say in the Caribbean.

Being a journalist affords me the opportunity to work long into my retirement years even if I dial it back to part-time. Plus if my dream comes true I’ll be a successful investor making boatloads of money buying the hottest growth stocks. Watch out Jim Cramer!

How I live now

Currently I’m in an enviable position, at least on the real estate front. My house has appreciated substantially since I purchased it seventeen years ago. It’s not over $1 million but it’s getting close.

Once the mortgage is paid off and taxes are covered I should have around $500,000, granted home prices where I live continue to grow in the years between now and my youngest child’s high school graduation. Only six more years to go!

I also have retirement savings in a 401(k), but to be honest not as much as I should. I am ramping that up and plan to take advantage of catch up contributions in the coming year or two.

My retirement savings is in a target-date-fund, which shelters it somewhat from the gyrations in the stock markets, particularly in the past few weeks. I do plan to collect Social Security, but as of now I have no clue how much it will be each month.

I try to stay healthy, exercise and live an active life. My family is by and large healthy so I have good genes on my side. (I have not planned for any long-term care I may need as I get older.)

While I have debt, it’s not too out of control. I do like to shop but I’m reigning that in too. There’s only a few more must-have purchases on my list!

Can I do it?

Sounds like an obtainable dream right? Not so fast, says Pam Krueger, founder and CEO of Wealthramp, an online service that matches investors with financial advisers

Ugh.

While it’s possible, Krueger says it’s not the slam dunk plan that I so confidently assumed. So much for being a genius.

Just because I’m sitting on a little nest egg in my home, Krueger tells me I will have to make some changes now to position me for the future I envision. I also need to plan a lot more for all the curve balls life tends to throw our way.

That’s a hard pill to swallow. I’m more the “everything will work out” type, rather than the “plan for the next five, ten fifteen years” type.

“It's a lot fun opening your mind to the tremendous freedom of getting beyond the college age and what you can do with that freedom,” says Krueger. “But you have to stay in your current financial nest built around right now. The question becomes when I’m looking at the future plan, what do I need to be doing today.”

That’s not to take away from having a vision, she says. There are so many people who have no idea what they will do when they retire or if they can or will continue to work.

“I’ve got this picture in my head of you sitting in the sunset, sipping a cocktail and still getting paid to do great work. You are not ball and chained to a job unless you want to be. You don’t have to stop doing what you are doing. Most people have this jarring cliff they have to jump off,” says Krueger.

Yay me!

But now for the tough love and reality check.

While I have my house to fall back on and the potential to continue working, I don’t have enough saved for retirement, have no idea how I would cover any long-term illnesses when I get older and am clueless as to how much my Social Security benefits I will receive each month. Plus I spend a lot of money that I don’t need to.

That eyes-closed, don't worry about it approach may have been fine in my 20s, 30s, and 40s, but now it’s no longer an option.

“You’re not 30 or 40 you can’t mess this up. If you want to get this right and live out this vision you have to take it extremely seriously,” says Krueger. “You don’t have enough money.”

What I need to do

First up, Krueger says I have to focus on building up my safety net. Sure it’s not as fun as thinking about how I’ll invest or where I’ll sip cocktails as the sun sets, but I need to start assessing where I’m at today.

For starters I need to know how much my projected Social Security benefits will be each month. That’s an easy one. A visit to the Social Security website will give me that information.

I also need to accept that in my situation I will likely be working full-time until at least 67, even if I sell my home and move. That will give my Social Security benefits more time to grow and for me to save more in a tax-advantaged retirement savings plan like my 401(k).

I also have to consider some of the unknowns--the value of my house in six years, the state of inflation, the size of my retirement savings account, the impact of taxes, and whether or not my children will come back home after college.

How I’ll allocate the proceeds from the sale of my home is another consideration. I know I want to downsize, but by how much and where, are things I need to ponder. Plus what if the unthinkable happens and I get sick? I don’t want to be a burden on my children and loved ones.

“Taxes, inflation and long term care are looming as huge risks to your plan,” says Krueger. She says now is the time to consider taking out long term care insurance. If I wait until I’m older and something happens it could be too cost prohibitive. Plus I don’t want to be a burden on my kids.

As for my spending, Krueger says it’s time to be realistic about how I live and identify ways to free up extra money, which can go to my savings. That could be forcing myself to cook meals at home, or splitting take out between two meals instead of one. Maybe it means cutting back my caffeine habit or brewing it at home. If I cut those little expenses it can add up to some big savings.

“You have to assess your spending. You can’t get to the vision if you are not willing to do this and be crystal who you are and how you live. You have to know what you are spending on,” she says.

After I do all that I can start thinking about how much money I will have left to dabble in the stock market. The idea of chasing high growth stocks is appealing but I don’t want to invest $10,000, lose it and have to work full-time well into my 70s.

Bottom line

At the end of the day Krueger says it can be prudent to get the help of a financial adviser. Sure it may cost me $2,500 or $3,500 but working with a professional could create a blueprint that puts me on the right path.

I admit I'm a little bit overwhelmed by all the things I have to do, I'm fired up and for now will focus on the things I can control like spending and saving. I have time to get this right and achieve my great big retirement plan!

Related content

Get Kiplinger Today newsletter — free

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Donna Fuscaldo is the retirement writer at Kiplinger.com. A writer and editor focused on retirement savings, planning, travel and lifestyle, Donna brings over two decades of experience working with publications including AARP, The Wall Street Journal, Forbes, Investopedia and HerMoney.

-

Don't Let Chronic Illness Costs Drain Your Retirement Savings: Here's How

Don't Let Chronic Illness Costs Drain Your Retirement Savings: Here's HowIf you have a chronic illness, you know that the proper care can be expensive and, in many cases, lifelong. Here's how to get the healthcare you need in retirement.

-

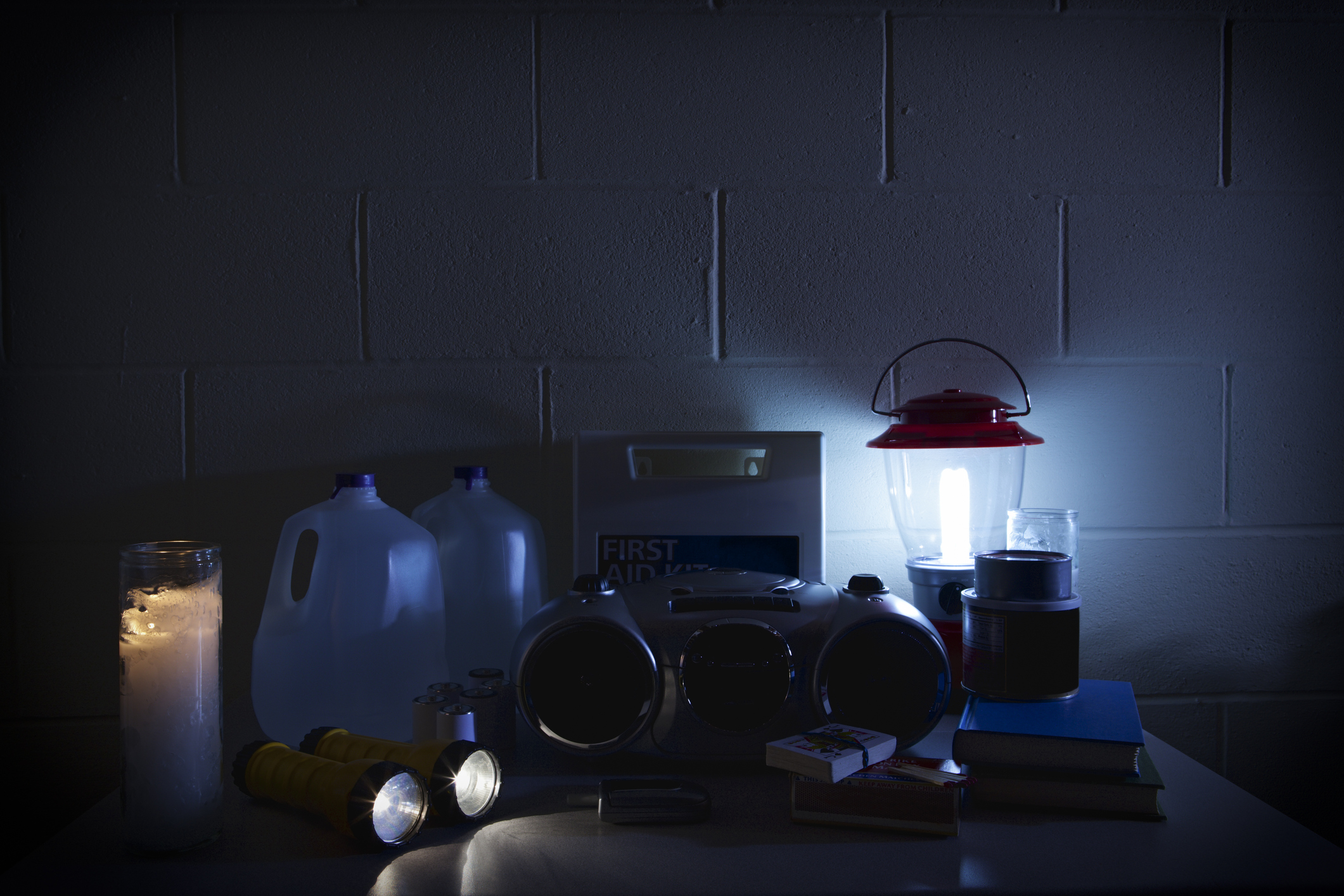

Prepping for Power Outages: How to Keep Comfortable Amid Strong Storms

Prepping for Power Outages: How to Keep Comfortable Amid Strong StormsPower outages happen at any time. Use these tips to keep comfortable when they occur.